Why I bought STEPN NFT?

The way I see P2E, it's one of the ways games acquire users and consequently bootstrap their economy. The idea is that gameplay, complex mechanics, and the overall economy of the games will hook players for the long run. In contrast, aggressive inflationary emission of the token can lead to habit formation in the short run. Hence it is necessary.

Habit formation is crucial. In today's digital economy, attention is a scarce resource. From millions of Tiktok videos to hundreds of yield farming strategies and games, convincing a user to allocate time to your game is challenging. Token incentives helps. Once the habit is formed, the user becomes sticky (low churn) and advocates the product to its friends and family, they to theirs; consequently, many are onboarded, the flywheel is spinning, and the network effect gets achieved.

One example is below where my colleague is happy that he is earning $ with his STEPN sneakers NFT and tells me to buy not one but at least three sneakers NFT so I can walk 20 minutes to earn the GST tokens optimally.

What makes STEPN exciting?

It is that it's taking this P2E concept and applying it to fitness – leading to a new primitive called "Move-To-Earn" (M2E). Users can earn income by exercising, which is the first. The more I introspect, the more I feel M2E might be more sustainable than P2E. Because even if the rewards are low/fractional as the token emissions slow down, many users would be grateful that they formed an excellent habit of exercising and their overall health/fitness has improved. This implicit utility might not be evident just by evaluating token economics doc.

How does it work?

The mechanics are very similar to Axie infinity but just applied to fitness.

Every user is required to purchase at least one Sneaker. Each Sneaker is unique (i.e., NFTs) and has four attributes (Efficiency, Resilience, Comfort, Luck) that directly impact its earning potential.

Earning power of these NFTs can be boosted through upgrades. You start at Level 0 but are upgradable to Level 30. Each additional level upgrade costs progressively higher GST. Process of upgrading burns GST (taken out of circulation). Once sneakers reach a certain level, they'll unlock gem sockets. Users can enhance the stats of their sneakers by inserting the corresponding gems into the sockets.

Sneakers come in many different types (optimized for walking, jogging, etc.) and with different

The game initially has a supply of 10,000 sneakers. And the total shoes in circulation can only be increased by breeding (minting) new shoes from any two existing shoes that have reached Level 5 or higher. Each shoe can be used for breeding seven times, with each consequent breed requiring progressively higher GST to be burned. This does two things first; it prevents the NFTs (Sneakers) from becoming hyperinflationary (support increase in floor price), 2) implies that for the total sneakers supply to increase, the floor prices have to surpass the cost of breeding them.

Tokenomics

GST

GST is the token you earn from moving. This is equivalent to Axie infinity SLP. It's uncapped (unlimited) and is issued for reward users to move. It is also required for breeding new shows and upgrading the levels of the shoes both action makes the GST token deflationary (via burning).

This deflationary bit is temporary. Given the total Sneaker, supply can only be increased via breeding. Initially, all users would want to upgrade shoes to optimize their earning potential (reflexivity) majority of GST token issuance will be absorbed by the token burn. When user growth slows down, the token will become increasingly inflationary over time. This also happened with SLP – prices collapsed 90% from ATH, and supply increased from 500 million to 5.32 billion. Hence don't recommend buying GST for long-term portfolio allocation.

GMT

GMT is STEPN's governance token and primary value capture within STEPN's business model. This token is similar to Axie Infinity's AXS token and will have a fixed supply of 6 billion tokens.

STEPN's revenues are obtained from a take rate applied to shoe-minting, shoe-trading, and shoe rentals (in the future). The tax will range from 4-8% and will accrue to the stakers of GMT in the form of dividends. Staking GMT for more extended periods will also increase the voting rights on governance proposals. Currently, the market is too pricing in too much growth, and I feel that at $7 billion, FDV GMT has run ahead of itself. Hence, owning GMT might not give you asymmetric R/R.

How will I play it, and why am I bullish?

The best way to play this M2E primitive is by buying NFT Sneakers directly. At current floor prices of ~10 SOL token rewards from exercise have a decent annual yield of (300%)+ although these yields will compress further, think of this as free money. Moreover, given the rapidly rising user base, I am confident demand for new shoes will surpass shoe supply growth, putting added upward pressure on floor prices. I expect this to remain for the next 3-6 months. If I am wrong, at least you formed a fitness habit and are more healthy ;)

For any new primitive to have long-term success: It needs to become a habit. Long-term habits are formed when something is motivating, fun, addicting, and has rewards ( token incentives and health in our case). STEPN is hammering on all these fronts.

Although STEPN is in its very early stage, the growth has been astonishing. There are signs STEPN is achieving hyper-growth

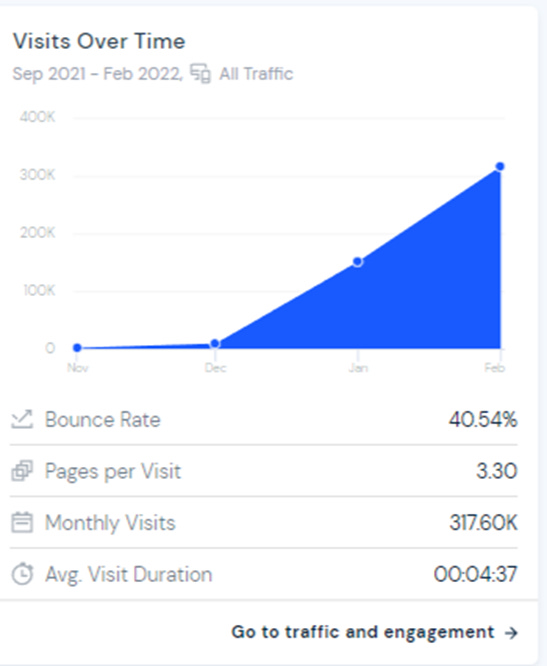

In Feb, they reached 21K Daily Active Users and 66K Monthly Active Users. In March, this numbers has jumped to 100K+ and 500K+ respectively. Apart from that, their Twitter followers have grown from 60K in Feburary to 133K today The number of website vistors also started to go vertical in Feburary.

STEPN apart from its strong game economics regulation (multiple demand sinks) also has an ESG angle. Governance voting decides how much profit STEPN will donate for the cause of Carbon Neutrality by purchasing carbon credits.

They are also about to launch a rental system the gives them the ability to to acts as a proxy guild. Rental system enables non-crypto users to try for free and once they have saved up enough tokens, they can buy a sneaker NFT. Rental system also appears to be robust with credit rating and use of smart contracts to settle the rental agreement. This will also open a massive TAM – almost everyone walks / runs, not bearing that fitness already has a hugeee TAM!

Their road map also has plans to further gamify fitness by having a marathon mode where users need to pay a fee to participate and top-ranked players or groups receive PvP rewards.

Further optionality could be since STEPN uses its proprietary app to track movements. M2E primitive can be expanded to swim 2 earn; bodybuilding 2 earn; deep work 2 earn, etc. I think I am getting ahead of myself here, I will stop here!